Planswell Attracts 2,000 Applicants with Unbiased Hiring

Toronto-based Planswell offers remote work, performance-based opportunities

Planswell, the financial startup that provides free, actionable financial plans in minutes, today revealed over 2,000 candidates across North America have applied for employment in the first two weeks of March and over 200 have been onboarded. The company credits a thriving remote culture and an innovative, unbiased hiring process for its ability to attract top talent.

“There is a prevailing narrative across all industries that we’re experiencing a labor shortage,” said Eric Arnold, CEO. “We think it’s a respect shortage.”

Continues Arnold, “There are a lot of hard-working people who don’t get the chance to rise to their potential because they haven’t had the right opportunities or they don’t have the right diploma. None of that matters here.”

Planswell’s progessive hiring program offers lucrative sales positions—no previous experience nor resume required. Candidates who wish to participate receive one-to-one daily coaching, weekly access to Planswell executives, and a playbook for success. Rapid promotion is actually achievable and new hires receive a competitive salary, uncapped earnings, and full benefits within 30 days; within 90 days, the base compensation can double.

Through this program, Planswell has attracted new team members with diverse backgrounds including executives from other industries, stay-at-home parents, and students. “We’ve found the traditional interview process is not an accurate indicator of success,” says Arnold, “We've created a merit-based approach to hiring that controls bias and allows anyone the opportunity to test working at Planswell and start getting paid on the first day."

Launched in Toronto, Planswell has been a fully remote workplace since February 2020. Planswell’s team spans six countries with no set working hours, unlimited paid vacation, a clear path for promotion, and a rapidly scaling customer base. The company is proudly committed to meritocracy; their about us page leads with the headline, “We are striving to build the world’s safest & most inclusive place to work.”

Planswell Enhances Free Financial Planning Software

Upgrades for advisors include goal planning and cash flow events

Planswell, the financial planning company offering free, personalized financial plans to consumers in under three minutes, today announced upgraded features for advisors using its software for free. Advisors can now help clients plan for major spending goals such as a dream vacation, as well as integrate significant cash flow events such as an inheritance, with the impact on retirement fully reflected in the plan. Advisors can schedule a demo of the software here.

"Our financial planning experience for consumers and advisors is advancing at a rapid pace "said Scott Wetton, Chief Operating Officer. “Planswell’s new goal and cash flow functionality drives the type of value advisors want to deliver to their clients.”

The enhancements allow clients to add savings goals to their comprehensive plan for specific spending events such as elective surgery or a dream vacation. Goals are integrated with the retirement planning engine, so the impact on retirement is reflected and the adaptive engine will find solutions with the goal considered.

“Consumers can now turn to their advisor with the question, ‘Can we afford this?’, and the advisor can instantly show them how to make their dreams a reality,” says CEO Eric Arnold.

Similarly, one-time cash events—deposits or withdrawals—are instantly integrated into the client’s plan, providing flexibility to handle life’s curveballs.

After investing upwards of $20 million to build its unique client-led planning engine, Planswell turned client prospecting and onboarding on its head by making its software completely free to both sides of the market in December 2021, spiking business by upwards of 25% in just two weeks. The end-client can build a comprehensive financial plan from their mobile device in just three minutes—including mortgage, debt, investments, and cash flow considerations—which is immediately available to their advisor.

In addition to Planswell’s proprietary financial planning software, the company provides highly rated advisor training and support, a popular CRM, a unique plan-building link, peer leadership, and a robust library of self-guided resources—all now available to qualified advisors free of charge. Advisors accepting new clients will also be eligible to opt into Planswell’s client-matching service on a month-to-month basis to meet their growth goals.

RELATED

-

Money Well Spent: The Family Vacation | Feel Better Blog

How to Spend an Inheritance | Feel Better Blog

Planswell to Offer Financial Planning Software to Advisors for Free

First-of-its-kind, client-led planning experience accelerates sound professional advice

Planswell, the financial planning engine offering free, personalized financial plans to consumers in under three minutes, today announced it will offer its advanced financial planning software to financial advisors in the US and Canada at no charge. Financial advisors will be able to leverage Planswell’s client-led financial planning software, previously priced at $199 per month, by simply getting a free account at planswell.com/advisors.

“Our mission has always been to make the world’s most actionable financial planning experience accessible to everyone,” said Eric Arnold, CEO. “We’ve been working to remove the traditional barriers that made quality financial advice a luxury, and to reshape the industry. Putting the best tools in the hands of qualified advisors is a monumental step in that direction. ”

After investing upwards of $20 million to build its unique client-led planning engine, Planswell launched a B2B offering for advisors in April 2020, pricing its software in line with others in the market. Because the planning experience is designed to be initiated by the end user—the consumer—it turns client prospecting and onboarding on its head, says Arnold. “We’ve built the fastest and most delightful plan-building experience for both sides of the market.”

In three minutes, the client can build a comprehensive financial plan from their mobile device—including mortgage, debt, investments, and cash flow considerations—which is immediately available to their advisor. Accelerating meaningful conversations between clients and advisors opens up advisor capacity to serve more consumers, said Arnold.

In addition to Planswell’s proprietary financial planning software, the company provides highly rated training and support, a popular CRM, a unique plan-building link, peer leadership, and a robust library of self-guided resources—all now available to qualified advisors free of charge. Advisors accepting new clients will also be eligible to opt into Planswell’s client-matching service on a month-to-month basis to meet their growth goals.

RELATED

-

Planswell Drops Fees For Financial Planning SoftwareWealth Management

Planswell Widens Access to Financial Planning SoftwareWealth Professional

Planswell Opens Up Free Financial Planning Tech to Advisers mllm-invest

Planswell Celebrates First Anniversary of Partnering With U.S. Advisors

After Expanding into the U.S. in 2020, Planswell has Delivered Over 100,000 Free Financial Plans

This time last year, Planswell announced its expansion into the United States, extending its reach beyond the borders of Canada. Since entering the market, Planswell, the financial planning engine offering free, actionable financial plans in a matter of minutes, has seen significant growth—partnering with over 1,600 financial advisors in the States in less than a year and developing an array of advisor support services. Over 100,000 free financial plans have been delivered to residents in every U.S. state and throughout Canada in the last twelve months. Following its successful expansion into the U.S., Planswell now has its sights set on launching in Mexico, Chile, Philippines, and Ireland beginning in 2022.

"We expanded into the U.S. with the goal of making financial planning accessible to all by bringing consumers and advisors together. Our partnerships with advisors led us to developing new ways to support them in their work," said Planswell CEO Eric Arnold. "We're grateful for all they do when taking Planswell households on as clients."

Chief among those innovations was the introduction of Plancraft, a platform that gives entry to a wide array of support critical to an advisor's success, including training, software, peer leadership and insights, and direct access to prospective clients.

By partnering with advisors and allowing families to develop free financial plans across the globe, Planswell's platform is set to become a leading instrument in helping individuals understand and reach financial security.

While Planswell originated north of the border in 2017, Canadian advisors are also now benefiting from the innovation coming out of the US business. "Planswell has transformed my practice," said Ryan Stevens, an advisor in Ontario. "I've been having by far my best year. Planswell is doing fantastic on the tech side. I couldn't be happier with the software. I think the most valuable part for me was the training…that really was a game-changer."

"Advisors worldwide should have access to the best possible tools to serve their clients," said Arnold. "Whether they are working in a major international city, or small town on the other side of the world, we strive for Planswell to be their go-to platform and ultimately to create a better financial future for everyone around the world."

For more information on Planswell, please visit: https://planswell.com/

.png?width=308&height=465&name=uncle%20sam2%20(1).png)

Introducing Planswell's Plancraft - An Exclusive Partner Platform For Financial Advisors

Plancraft Provides Advisors with Exclusive Monthly Peer Group Meetings, Prospective Clients, Financial Planning Software, Core Training, and More

Planswell, the financial planning engine offering free, actionable financial plans in under three minutes, is expanding its support services for partnering advisors with the launch of Plancraft. The platform gives entry to a wide array of support critical to an advisor's success including training, software, peer leadership, and prospective clients. Advisors level up when they connect with their peers and work in tandem on complex planning challenges – a luxury Planswell aims to provide with their offering that will ultimately benefit an advisor's clients.

The Plancraft platform enables financial advisors to lean into each other and offer insights, solutions, and resource recommendations that address the highs and lows of the profession. Each advisor works directly with a professional facilitator and in close-knit groups of eight to ten peers. Planswell offers Plancraft risk-free for $199 per month with no ongoing obligation or contract.

In addition to its peer networking perks, the all-encompassing partner platform offers access to:

- Monthly facilitated executive peer group meetings

- A proprietary financial planning software with unique referral links

- Advisor HQ, a robust library of self-guided training content

- A seven-day, risk-free core training program

- Exclusive webinars and workshops on trending topics in the industry

- Bi-weekly office hours with coaches and company leadership

When joining Plancraft, advisors may opt in to receive a guaranteed number of prospective clients per month, ranging from 10-50, based on the plan. Prospective clients (households) answer 30-40 questions as part of Planswell's free financial planning service and are strategically matched with a single advisor who best fits their needs and location.

"Exclusivity is key to winning trust with consumers," said Planswell CEO Eric Arnold, "To best serve them, we cannot overwhelm them with calls from multiple advisors. Plancraft training emphasizes a service mindset via a human experience with tactics to build rapid rapport."

Planswell is on a mission to prepare consumers for a sustainable retirement through access to financial planning. According to a recent study1, 22 percent of Americans have less than $5,000 saved for retirement, and 15 percent have no retirement savings whatsoever. To combat this concern, Planswell connects advisors with consumers who have financial questions and, with the addition of Plancraft, trains advisors in the soft skills needed to serve Planswell consumers long term.

For more information on Plancraft, please visit: https://partners.planswell.com/advisors

.png)

RELATED

-

Financial Planning Firm Planswell Intends to Supercharge Networking, Wealth Management

How New Offering Helps Advisors Hone their Craft, Wealth Professional

Planswell Fills C-Suite with Eye Towards Global Expansion

Early US success ignites drive to Latin America, Asia

Planswell, the Toronto-based startup delivering free financial plans in about three minutes at Planswell.com, is preparing for expansion to Latin America and Asia by filling key executive positions. C-suite hires join Chief Executive Officer Eric Arnold and Chief Operating Officer Scott Wetton to navigate rapid growth for the company.

Planswell entered the US market in October of 2020 with US revenue quickly surpassing business in Canada, the company’s home base. To date, over 1000 advisors in North America have partnered with Planswell from virtually every major financial institution— in addition to solo, independent firms—to help consumers action their financial plans. Planswell has delivered over 300,000 free financial plans to households located in every US state and Canadian province.

In preparation for further expansion, Planswell adds Trevor Oseen of Calgary as Chief Financial Officer. Oseen has extensive experience building companies around the world after landing in his first CFO position of a public, internationally traded energy company at 29. He’s since worked in eighty countries while finding time to complete 23 marathons and seven Ironman triathlons.

Jennifer Mastrud joins as Chief Marketing Officer after over twenty years of notable marketing leadership experience in diverse sectors ranging from globally syndicated TV to SaaS. She has an impressive track record of turning young startups into industry leaders, building scalable marketing systems, and managing remote teams. Most recently, Mastrud led two-sided national marketing efforts aimed at financial advisors and financial planning clients. Based in the US, Mastrud is a forty-year survivor of Minnesota winters.

Dean Khialani, a Florida-based technology visionary with a Ph.D. in Information Systems, joins as Chief Technology Officer. Specializing in big data, blockchain, machine learning, and artificial intelligence, Khialani has over 20 years of experience turning code into profitable products in C-level roles at startups and large, established corporations alike.

Scott P. Gill, a leading expert on the US financial regulatory environment, joins as Chief Compliance Officer heading the development of Planswell’s US planning engine. Gill brings guru-level knowledge of RIA compliance after advising hundreds of firms throughout fifteen years in the business. Based in North Carolina, Gill is currently completing a doctorate and operates a charitable organization he founded to serve the homeless.

The executive team leads remote staff dispersed across Canada, the United States, the Philippines, Serbia, Turkey, and Nigeria.

“I am so humbled,” said Eric Arnold, Planswell Chief Executive Officer, “This leadership team is much more experienced than me. I’m confident we’ll succeed in Latin America and Asia by the end of this year.”

RELATED

-

Planswell Bulks Up C-Suite, Hires Former XYPN Directors, Wealth Management

-

Planswell eyes global expansion with C-suite appointments, Wealth Professional

- The Worst Career Advice You've Ever Gotten featuring Planswell CEO Eric Arnold;Think Advisor

Planswell Announces US Expansion

Toronto-based FinTech company brings free financial plans to Americans starting today

Planswell, the Toronto-based startup delivering free financial plans to users in three minutes, today expands its offering to US residents. Starting today, Americans from coast to coast can build a free financial plan by going to Planswell.com.

Free of charge, US residents can enter a series of basic details and, within minutes, understand the most tax-optimized way to contribute to their investment accounts, how much life and disability insurance they would need if something were to go wrong, and how to most effectively reduce the interest they’ll pay on debt. They can now see exactly how their investments will impact their retirement based on all applicable state and federal tax rules and social security.

“We’ve been building our planning engine for five years on the back of fifteen million dollars worth of technology.” said Eric Arnold, Planswell Chief Executive Officer. “The US was identified as our first expansion market for several reasons, including the size and needs of the population and the overwhelming response to early testing.” Planswell has conducted successful product tests in 18 countries to date.

“We’re finding few know what to do on a monthly basis to maintain their lifestyles in retirement,” said Arnold. “Our mission is to provide the most actionable financial plans to everyone, for free. The only thing slowing us down is how fast we can adapt our planning engine to local financial planning standards so everyone can have the perfect plan.”

Planswell has seen rapid growth since April 2020 when they made their beloved consumer-centric software available to financial advisors to use with their own clients. Advisors using the software must also have capacity to serve additional clients as Planswell encourages consumers to work with a professional to implement their free plans. “We’re working with hundreds of experienced advisors across the country, from virtually every financial institution, to continuously elevate the planning experience for consumers,” said Scott Wetton, Co-Founder and Chief Operating Officer. “These partnerships have allowed us to supercharge the development of software for other countries.”

Since April, the full-time team has grown to more than forty people working remotely from seven countries, including the US. “In quick order, we’ve been able to assemble top talent from around the world,” says Arnold, adding the company has remained cash flow positive during the rapid expansion.

“America is just the beginning,” said Arnold. “We’ve set our sights on making a global impact.”

.png)

RELATED

- Planswell Offers Free Financial Plans that Help People Optimize Insurance, Investments, and Home Loans, BadCredit.org

- Canadian FinTech Planswell Enters Crowded U.S. Market, Wealth Management

- Launching in U.S. is the 'obvious next step' for Planswell, Wealth Professional

Planswell Data: Canadians Prosper Despite Pandemic

Data analysis reveals income, savings, and home values trending up among 100,000 Planswell users

"Like others in the financial space, we were eager to see how Covid would affect the financial wellness of our citizens," said Eric Arnold, Planswell Chief Executive Officer. "In the data, we certainly didn't see the devastating effect we all feared. In fact, it seems Canadians are prospering."

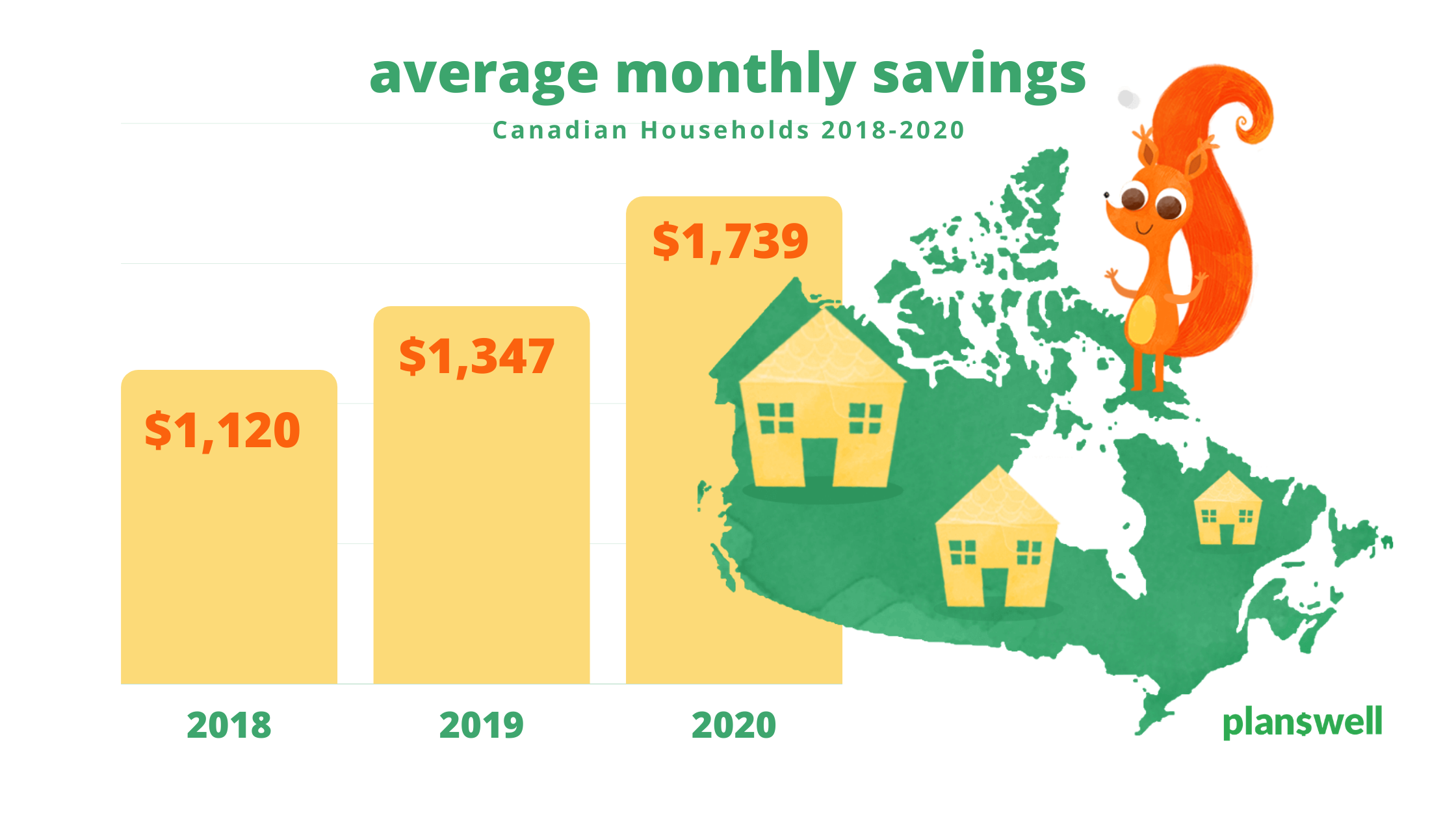

Planswell looked at data from a randomized and anonymized sample of 100,000 financial plans created at Planswell.com since 2018. To build free, actionable financial plans, users spend a few minutes providing information on household income, monthly savings, total investments, home values, mortgage balances, group benefits, smoking status, and more.

From 2018 to 2020, income rose 8.5% and the percentage of income that went into savings rose from 9.5% to 14.5% with the average household now saving $1,739 per month. Although mortgage debt rose 7.4% to $195,857 on average, home values over the period are up 21.4% to $509,352.

Average household assets topped $300k compared to about $200k in 2018, a spike that speaks to Planswell's consumer demographics as the company focuses on outreach to wealth accumulators versus retirees. Arnold pointed out the figures are self-reported by Planswell users who are typically between thirty and 65 years old.

Despite the turbulent and stressful year for working Canadians, the percentage of people with group benefits remained unchanged over the period at just over 74% and smoking rates continued a downward trajectory from 7.9% to 6.2%.

"It's encouraging," Arnold said, "An isolated look at 2,000 plans created over Labour Day weekends in 2019 and 2020 shows a meaningful uptick in the financial health of Planswell users across Canada, contrary to fears when the pandemic began."

Planswell, the Toronto-based startup delivering free financial plans to users in three minutes, today released findings from aggregated data collected in Canadasince 2018 revealing upward trends in income, savings, and home values. The data analysis of 100,000 like users shows an encouraging sign of resiliency among Canadians during the Coronavirus pandemic.

Planswell Helps Advisors Serve Clients from Home

Remote financial planning system now available to 200,000 Canadian advisors

Effective immediately, Advisors can offer free financial planning in minutes and support their clients across Canada through planswell.com.

"We've been testing and refining this remote planning system with advisors across four countries for the past two years" said Craig Savolainen, Head of engineering. "After listening to the success stories and international advisors and our own team in serving hundreds of thousands of users, we realized this is something that can add tremendous value to Canadian financial advisors and their clients."

The team at Planswell in Toronto has worked hard to create a unique online financial planning experience that allows users to maximize their investment potential, minimize their borrowing costs, and financially protect their families.

For the first time, it's now available to any financial advisor in Canada at Planswell.com/advisor.

Canadians need financial advice more than any other time in history. Advisors need new ways to connect with and add value to their clients remotely more than ever before.

"How does an advisor sitting at home manage to create and update financial plans for hundreds of their clients this month? This is what advisors have been asking." said Eric Arnold, CEO of Planswell. "We're sitting on the perfect solution. We've been the experts in remote financial planning for years. If we can make our system available so financial advisors can use Planswell to make a huge difference for Canadians, it just makes sense."

How it works

It only takes about three minutes to create a free plan at planswell.com. Once a client builds a plan, they can schedule a free walk-through with their advisor, who can fine-tune their plan and provide advice on how to make it a reality.

- Build a plan

Answer 30-40 questions in three minutes to create a free financial plan. The questions are easy and can be answered off the top of your head. - Walk through the plan

See exactly what to do each month to grow your wealth, reduce your debt, and be protected from financial surprises. This can all be done before speaking with an advisor. - Improve and implement the plan remotely

Over the phone or video chat, Advisors can guide clients through each step of the plan, to keep them on track for their goals, retirement and beyond. Advisors easily update the plan and push changes live in real time while speaking to the client.

.png)