Despite the conspicuous absence of dragons and fire magic and the relative prevalence of personal (particularly dental) hygiene, our world has more in common with Westeros and Essos than you might think—especially when it comes to economics.

Okay, sure: Westeros has no stock market and their economy is still based on actual physical gold pieces, but Petyr Baelish’s pronouncement that “gold wins wars, not soldiers” rings as true on Earth as it did in Westeros.

Besides, despite significant differences in social and economic structure, there are still plenty of lessons to learn about financial planning from the characters and events of Game of Thrones.

We may be four years late on the GoT hype train, but it’s never too late to learn investment strategy lessons from one of the most popular TV series of all time.

SIDE NOTE: This article contains some minor spoilers for the Game of Thrones series. You have been warned.

Wealth Management Lessons from Key Game of Thrones Characters

There are several characters in the GoT universe whose behavior teaches valuable financial lessons.

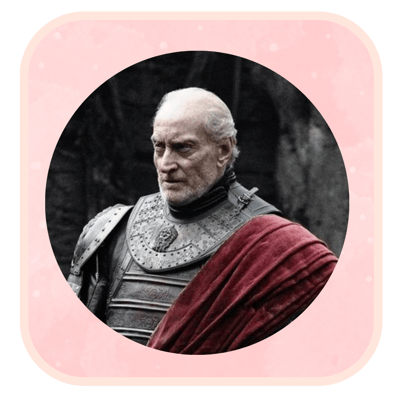

Tywin Lannister — The Importance of Diversification

“A Lannister always pays his debts,” true, but how can they do so when the gold mines that fueled their wealth have all run dry? Diversification, that’s how.

As the head of House Lannister, Tywin knew that, if his house were to survive, he would need to diversify his investments, so to speak. He took several steps to do this:

- Astounding credit: with a house motto like “a Lannister always pays his debts,” everyone knows they can trust their investments in House Lannister will pay dividends. Even after the gold mines run dry, Tywin uses his house’s good name to leverage beneficial arrangements that keep him in power.

- Royal clout: by marrying his daughter, Cerce, to King Robert and funding his (Robert’s) extravagant lifestyle, Tywin assured the Crown would be forever indebted to his house.

- Powerful allies: Tywin leverages his royal clout to acquire the Tyrells (a wealthy house known for their bountiful harvests) as allies. By arranging to marry his grandsons (both of whom were king, for a time) to Margaery Tyrell, he ensured he would have access to the Tyrell’s wealth even if his house’s ran dry.

When it comes to learning lessons about investment management, Tywin is a great place to start: by diversifying his sources of power, he is able to keep himself (and his family) in power despite losing the one resource for which his house is known.

The Iron Bank of Braavos — Investing Safely

Referred to as “the world’s best gamblers,” the Iron Bank of Braavos is notorious for being incredibly scrupulous when it comes to deciding whom to back and whom to shun (financially speaking) — they prioritize the security of their investments above all else.

Granted, in Game of Thrones, the two narratively relevant investments the bank makes fail (and miserably). However, their history of sound investing (and relentless debt collection) have established them as a financial powerhouse with the capability to weather a few bad investments here and there.

When it comes to modern investment strategy, the Iron Bank is an excellent model. Ensuring long-term profitability with a bedrock of safe investments will give your clients the opportunity to capitalize on potentially risky opportunities which have a chance of paying much higher dividends.

Petyr Baelish — Capitalizing on Opportunity

Unlike Tywin Lannister, who was born into power, Petyr Baelish (a.k.a. “Littlefinger”) built himself up from nothing. By capitalizing on the opportunities presented to him, he was able to rise from a peasant boy to the rank of Lord.

As a ward of Lord Hoster Tully, a young Petyr Baelish ingratiated himself with Lord Tulley’s daughters, particularly Lysa. He used his relationship with Lysa to continually improve his position: her husband granted him the position of Chief Customs Officer, and eventually he was appointed Master of Coin.

When he felt the political tides in King’s Landing shifting, Littlefinger betrayed those who had helped him rise to power in order to further his position.

Should you betray your current clients in order to earn the favor of those with a higher net worth? Absolutely not. However, keeping your ear to the ground for opportunities your clients may want to take advantage of is an excellent way to foster long term relationships.

Doing so will cause your clients to see you as the kind of financial advisor who gives them access to niche, bespoke advisory services that aren’t available elsewhere.

Game of Thrones Strategies for Wealth Management

Beyond individual characters, there are a few other sources of investment wisdom to be found in the Game of Thrones series.

The War of the Five Kings

The war to claim the throne from allegedly illegitimate King Joffrey is another lesson in the importance of diversification and careful, strategic planning. At several points during this war, it seemed as though there would be a clear winner: Renly Baratheon had more men than his brother, but was assassinated using blood magic. Stannis Baratheon’s army dwarfed that of the Lannisters defending King’s Landing, yet he was outmaneuvered and his fleet was destroyed. Robb Stark had the Lannisters on the run but broke a vow and ended up being murdered for it. The list goes on.

What financial lessons could possibly be learned from this tangled web of battles and backstabbing?

Be prepared for anything.

The global financial market is at least as complicated as the political knot of Westeros, and the savviest of registered investment advisors will be well positioned to weather any storm that might come up.

Winter is Coming

Not only is it important to be prepared for outcomes you might never have expected, any wealth management plan worth its salt will also be sure to expect the worst and be prepared for that as well.

The Starks of Winterfell are famous for foretelling doom with their house words “Winter is coming.” However, as Maester Aemon says, “the Starks are always right eventually; winter is coming.”

In the days where banks and companies rise and fall faster than a dragon taking flight (or being shot out of the sky), it’s important to have a plan for when the plan goes south.

What Did We Learn, Exactly?

In case the pearls of investment wisdom got lost amidst the sandy grit of Game of Thrones plot points, here’s the essentials:

- Diversify your investments, even when you’re confident you have a bottomless gold mine.

- Establish a foundation of safe, reliable investments so you can take advantage of riskier opportunities that may come your way.

- Capitalize on the opportunities with which you are presented.

- The financial world is horribly complex and anything could happen at any time. So, you must be prepared for the unexpected.

- Expect the worst and prepare for that too.