It’s true: “a poor artist blames their tools.” It is also true, however, that great artists tend to use great tools. As a financial advisor, you have a variety of tools at your disposal, perhaps the most important of which is financial planning software.

But what if you could have access to a comprehensive financial planning engine complete with a CRM and task manager for free?

Well, actually, you can.

Planswell's proprietary financial planning software has a whole slew of convenient tools financial advisors can use to streamline their practice, offload menial calculations, and engage prospects, and we don’t charge anyone to use it — ever.

We think it's a real no-brainer, but we'll detail why you should give it a look, even if you’re mandated by your head office to use another platform or you already have a favorite. Planswell’s free software has plenty of unique features to compliment what you already have.

Right off the bat, there’s a few things you should know about our software:

- It’s 100% free to use in its entirety. No strings, no gimmicks, no hidden paywalls for essential (or even non-essential) functionality.

- Our financial planning software is on the exact same platform as our client-led planning engine. So, when a client or a prospective client completes discovery on the platform, you get their information seamlessly in the CRM in real time.

- Again, you don’t have to use it if you partner with Planswell. If you want our help with prospecting or professional development but prefer to use your own software, that’s totally fine with us. We’ve even made it easy for you to export client data out of our system to input into yours.

How Planswell Works

Planswell is much more than an excellent financial planning engine. We also have an amazing client-led prospecting service whereby households interested in securing their financial futures are able to build a personalized financial plan on our platform in minutes, simply by answering 40 questions about their personal finances.

As great as our plans are, however, the best financial plans are built with human intuition and interaction. So, once their plans are built and they SMS-validate their phone numbers, Planswell matches each household with a financial advisor working in their area who can review their plan and make recommendations for how the household could retire sooner or with more money.

We also send you, as a partner advisor, a copy of the plan, so you can have a foot in the door with recommendations ready to go, courtesy of your new favorite software

Key features

Abundant Household Data

Planswell advisor partners have access to all of the information our planning engine uses to build each financial plan — more than 40 data points on everything from family size to annual income to retirement goals.

This kind of information is a godsend for prospecting purposes. Not only does it allow you to enter your conversation with pre-planned recommendations about financial products that would be of value to households, but it also helps you engage them with thoughtful questions demonstrating your vested interest in their financial (and general) wellbeing.

(If you aren’t convinced of the importance of demonstrating care for your prospects, you can read all about it here.)

Our software doesn't merely give you information, however — it builds financial plans too.

Easily customizable planning process

That’s right — our software builds every household a comprehensive financial report based on the information they input during discovery.

Does this make advisors’ role obsolete? Not in the slightest.

Having instant access to a complete plan saves a mind-boggling amount of time and it’s an incredible engagement tool.

The robots that build our plans are good, but nothing beats a human who can also take emotion into the equation. What’s more, they don’t have human intuition or life experience like you do.

So, when you review a prospect’s plan, it’s beyond likely you’ll notice areas where their plan could be improved, and suggest tips and tricks they could implement in order to be able to retire sooner or have more money at their disposal once they do retire.

Reviewing a premade plan is also a great way to engage prospects in the financial planning process and get them excited about the possibilities awaiting them.

Plus, our software allows you to easily tweak any of the inputs used to create the financial plan as often as you like. The plans update in real time according to your adjustments, so it’s easy to show your households how making changes to monthly savings or college fund contributions or lifestyle expenses can impact their retirement.

Cash flow optimization engine

How does our software build comprehensive financial plans for everyone who fills out our discovery form? Cash flow optimization, that’s how.

Our system calculates the amount of monthly income a household has at its disposal (after taxes and whatnot), and then — taking retirement goals into account — creates a cash flow plan optimized to create the most utility and spending freedom post-retirement.

Of course all of this is just as customizable as the plan is itself. So, if a household knows they’ll be inheriting a large chunk of money at a certain point (or if they’re going to have to pay for an expensive medical procedure), our engine can factor it into how it allocates funds on a monthly basis.

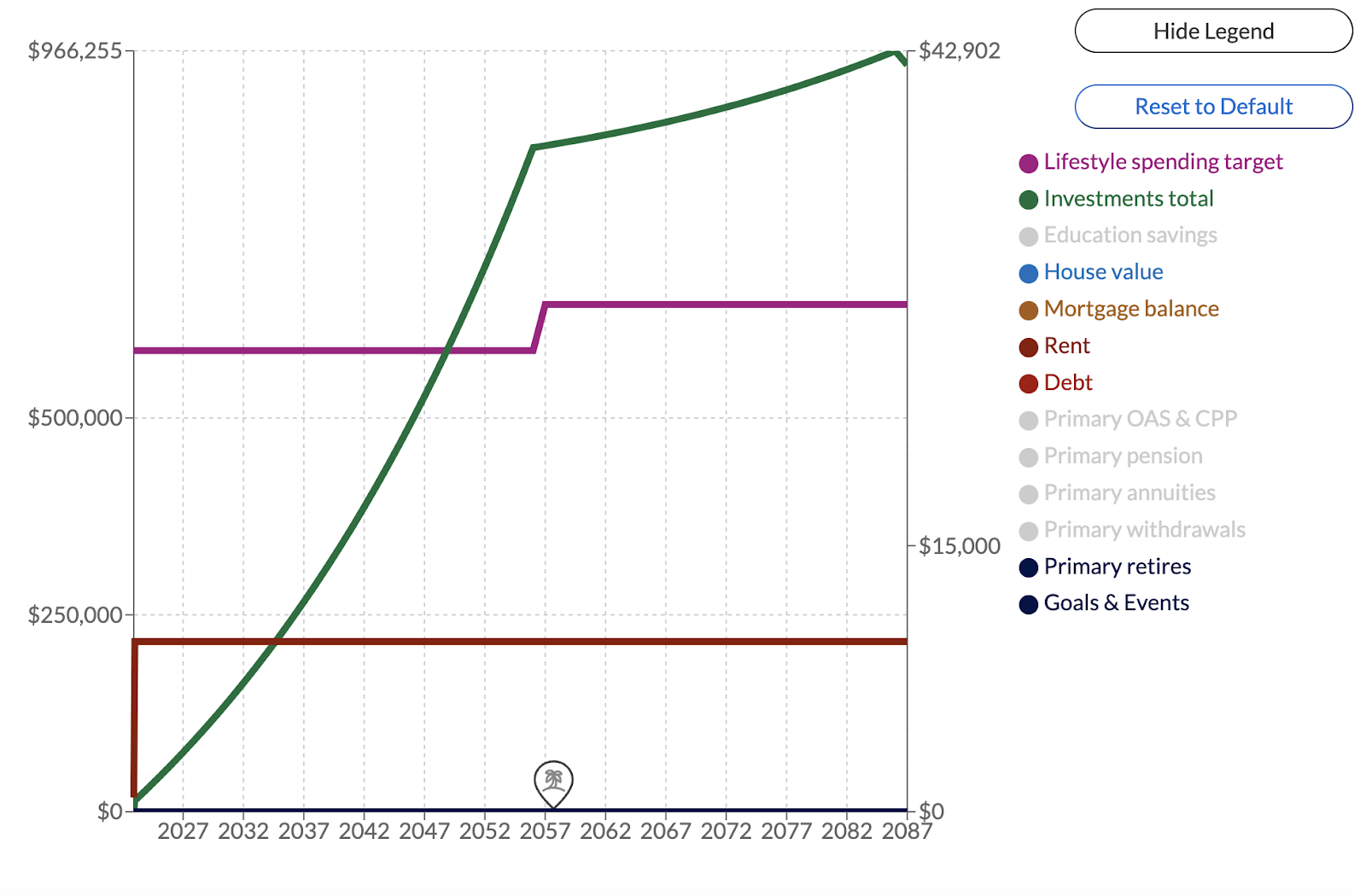

Visualization tools

Here at Planswell, we buy into the maxim “a picture is worth a thousand words.”

Especially when speaking with households who may not have any sort of financial knowledge whatsoever, being able to use visual representations of savings and retirement goals can go a long way towards helping someone understand their overall financial situation. (And, of course, a person who has conceptual understanding of their overall financial situation is going to be more motivated to either change or protect it.)

To help facilitate this understanding, our software generates several helpful charts you can use to help educate households. Of course, all of these charts update in real time as you make adjustments to the plan.

Households can’t see these on their end, so you get to be the one to share them, which is another great way to build rapport and investment.

Goal-oriented planning

Financial goals — like buying a house or moving to Paris — are not often accounted for in financial planning software. UNTIL NOW.

Planswell’s software allows for the integration of any long- or short-term financial goals into each financial plan.

Simply tell the software a household wants to take their mother on a trip to Italy in 2025 and how much should be budgeted for said trip and it will seamlessly integrate it into the household’s financial plan.

Sure, this is incredibly helpful for both advisors and families in terms of generating accurate plans, but it also functions as an excellent way for advisors to engage with prospective clients — ask them what their goals are and follow up with genuine curiosity.

Not only does this provide value in terms of the plan itself, but it shows potential clients you care about more than selling them financial products — you want them to achieve all of their financial goals, not just the ones on which you make money.

Simple CRM & Task Manager

Most financial advisors already have a CRM, but for those who want to have everything in one convenient place, Planswell’s software has an intuitive and effective CRM built in.

Our CRM allows you to add prospects, track progress, and create task lists for each household.

The task manager allows for calendar-based reminders on a per-household basis, which means you can easily stay on top of follow-ups and other tasks right from your planning platform.

Unique referral link

One of the most exciting — and underutilized — aspects of Planswell’s financial planning software is the unique referral link we give to every advisor who uses our platform.

This is a link (and a QR code if you prefer) you can embed in your website, send in emails, add to business cards and tchotchkes, or — if you follow Planswell legend Ermos Erotocritou’s advice — tattoo somewhere obvious on your body.

Anyone who scans the QR code or clicks on the link will be brought directly to our website where they can fill out our discovery form and build their own custom-made financial plan in about three minutes.

Once their plan is made, they will show up in your CRM along with the plan they built and all of the information they used to build it.

This is one of the most exciting parts of our system because it’s one of the facets that helps transfer a lot of the work of financial planning away from advisors. It’s a consumer-driven process, naturally attracting those who are invested in their financial future and want to ensure they have a plan to move forward.

If building your business virtually is a goal of yours to expand your reach, the unique referral link is essential. Prospective clients will have some technical aptitude and a propensity for digital experiences.

Support

Planswell’s software is simple and easy to use by design. In fact, we’re quite confident even the most die-hard luddites could take to it without too much trouble or instruction.

Despite all of this, questions do arise, and help is needed from time to time. And when that happens, we’ve got your back.

Advisor HQ

For those who like answers at their fingertips, we have an encyclopedic archive of self-help articles related to our software (and everything else Planswell too).

Advisor HQ is easy to navigate and available 24/7 (just in case you have burning questions about your unique referral link at 3 am).

Weekly software training

If you have questions you could not answer yourself by perusing Advisor HQ, you can join weekly software training sessions hosted by none other than Scott Wetton, our COO.

Scott knows Planswell’s software better than basically anyone else, and he hosts these open-door sessions every week. Not only will he answer whatever questions you have about our software’s functionality, but he’ll also help you master all of the advanced features and cool hacks to ensure you get the most out of everything our platform has to offer.

Coming Soon

As exciting as Planswell’s software is, we’re not done innovating and adding value for our partner advisors. Our in-house engineering team is perpetually dreaming up ways to make your life easier. Here’s a couple exciting features we’ll be rolling out in short order:

Marketing automation

Here at Planswell, our goal is to connect households in need of financial advice with experts who can help them realize their retirement dreams. As a part of this goal, we want to streamline the process by which advisors connect with households and make onboarding as smooth and pleasant as possible.

So, we’ve been working on a system of marketing automation advisors can use to engage households in the financial planning process and warm them up to the idea of getting advice from a financial professional.

Expanded Service Offerings

Before 2023 is over, we’ll be adding the functionality for advisors to expand their offerings to clients directly through our platform.

Your client needs life insurance but you don’t offer it? No problem.

They’re a candidate for solar energy but that’s outside of your wheelhouse? We got you.

Advisors will have the option to toggle on and off any ancillary solutions their household may need. Now that’s good service. When you fulfill all of their needs, you cement the advisor-client relationship and make it impenetrable by competitors. You’re the go-to expert to help them reach their goals, and Planswell is the platform that helps you do it.