There are thousands of financial advisors out there, but nobody does it just like you, right? But how can you help prospective clients understand exactly how you beat out your competitors in terms of the value and service you provide?

By writing an effective value proposition, that’s how!

If you’ve been in any sort of sales-based industry for any amount of time at all, you’ve probably heard of value propositions, and may even have written a few yourself. But, in case you need a refresher or you’re new to the game, we’ve got you covered.

Read on for a complete breakdown of how to write an effective value proposition that will boost your close rate.

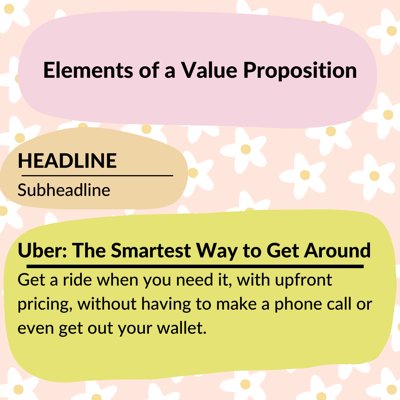

Elements of a Value Proposition

First, the basics: a value proposition is a statement you make that illuminates in easy to understand language what a client will get out of working with you.

The whole purpose of a value proposition is to set yourself apart from your competitors, but if everyone is making them, how do you ensure that yours stands out?

Before we get to those specifics, there are some general elements that you’ll want to ensure you consider.

Headline

This is a catchy sentence that clearly explains the value potential clients gain from working with you. You might think of it as a slogan that evokes the core essence of what sets your business apart from competitors.

Here are a few value propositions from well-known companies:

- Uber — “The smartest way to get around.”

- Digit — “Save money without thinking about it.”

- Apple — “The best experiences. Only on Apple.”

- Nike — “Customizable performance or lifestyle sneakers with unique colorways and materials.”

You’ll notice these aren’t exactly advertising slogans. They’re a bit more specific, helping prospective clients understand exactly what it is they get from these companies when compared to others.

Subheadline

A subheadline, in visual marketing materials like a flier or website, would appear right below the headline. Its purpose is to elaborate on the specific services you provide, how you provide them, and how your service offerings differ from your competitors.

In the case of Uber, they might elaborate on the headline “The smartest way to get around” by noting their services are cashless; have predictable, upfront pricing; and can be used without having to make a phone call (all of which distinguish Uber from traditional taxi services).

The Financial Advisor Value Proposition

Of course, as a financial advisor, marketing materials like this may not be your primary method of communicating with prospective clients — it’s likely that you engage with most prospects over the phone.

That doesn’t mean you shouldn’t have a value proposition written up that you share with prospects during your calls. Depending on the context of your meeting (e.g. whether it’s on the phone, in person, or over video conferencing), you might even be able to share physical or digital visual versions of your value proposition during your prospecting calls.

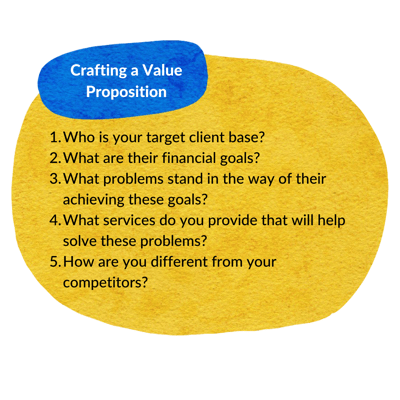

Crafting an Effective Value Proposition

The best financial advisor value proposition examples all have headlines and subheadlines, but they’re also tailored specifically to the advisor’s target market and offer tailored solutions to the specific financial planning and/or wealth management needs of the clients the advisor is seeking.

To ensure that your value proposition will be effective with your target audience, take the following steps:

Understand your client base

First of all, you need to decide who your client base is. Do you work with wealthy business owners who already have millions of dollars under management? Are your clients primarily new families looking to secure their children's educational futures? Perhaps you’re targeting young millennials who have potential to acquire significant wealth over the course of their careers?

First of all, you need to decide who your client base is. Do you work with wealthy business owners who already have millions of dollars under management? Are your clients primarily new families looking to secure their children's educational futures? Perhaps you’re targeting young millennials who have potential to acquire significant wealth over the course of their careers?

There are, of course, a near-infinite number of demographic buckets you could attempt to target as an advisor, and each of them has different financial goals and pain points they’re hoping to address through working with a financial advisor.

So, before you begin writing your value proposition, you’ll want to consider the following questions:

- Who is your target audience?

- What are some of their commonly-held financial goals?

- What problems stand in the way of their achieving these goals?

Tailor your services

Now that you have a solid understanding of your target audience’s needs, you need to find connections between the services you provide and those needs.

How can you be of service to these people? What problems of theirs are you well-situated to solve? How can you solve these problems?

If you consider Apple’s value proposition — “the best experiences. Only on Apple” — you can see how they tailored the way they portray their products to address a consumer pain point: PC computers and Android phones are often lacking in user-friendliness. They’re difficult to use, and are often plagued by viruses.

Apple computers are designed to provide a streamlined user experience that’s not only not frustrating, but actually enjoyable. Thus, “the best experiences.”

When considering how to write a value proposition for your business as a financial advisor, draw on your experience working with clients: what have some of the largest sticking points been? What parts of the financial planning process tend to turn customers off? How can you alleviate those pain points through the services you provide?

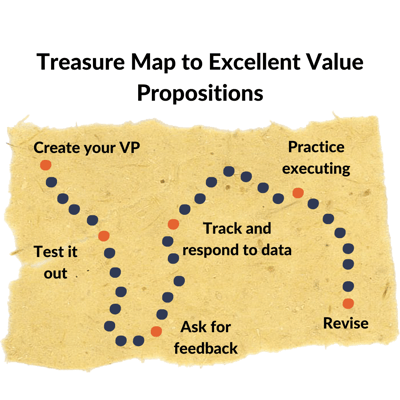

Maintaining Effective Value Propositions

Once you’ve got your value proposition written, you can go ahead and begin incorporating it into your prospecting calls. But, your journey is not over.

As you continue to implement your value proposition, you’ll want to continuously self-assess to ensure that it’s working as it should.

Ask for feedback

Ask clients you’ve closed what they thought of your value proposition. Did it do anything to move their needle?

Ask clients you’ve closed what they thought of your value proposition. Did it do anything to move their needle?

Even better, when you fail to close a prospect, you should always ask them why they’re declining to work with you. What about the services you offer did not seem like it would be a good fit for them?

This will give you invaluable insight into how you can update your value proposition to make it more effective with your target audience.

Track and respond to data

Don’t just ask for feedback and move on with your life. Make sure you’ve got an organizational system in place so that you can record data that helps you improve your value proposition over time.

You might even A/B test similar versions of your value proposition to see which performs better in terms of your close rate. Google Sheets is an easy-to-use (and free) tool you can implement to keep track of this kind of data (it will even make fun, colorful charts you can use to visualize what’s working and what isn’t).

Practice and get feedback

Writing the world’s best value proposition won’t do you any good if you can’t deliver it effectively on your calls. Practicing your script in advance of a sales call will be extraordinarily helpful, but even better is practicing with someone who can give you feedback.

If this kind of support sounds good to you, you might want to consider checking Planswell out. We offer one-on-one coaching, executive peer groups, and have tested sales scripts that work like a dream.

Ready for the really good news? You can get all that support for free.

-1.png)

-Oct-04-2023-05-28-33-7260-PM.png)

.png)