Ah, millennials: the generation of avocado toast, doom scrolling, and not being able to afford to buy a home. As a financial advisor, you may be wondering why you should be interested in acquiring new clients from a generation known for their general lack of financial literacy and their fate as perpetual renters.

Fair point.

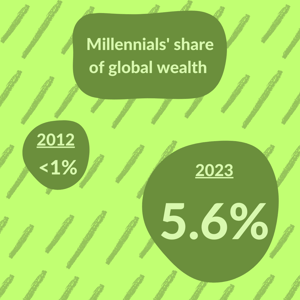

However, despite the fact that millennials (a.k.a. "Generation Y") own a relatively low percentage of overall wealth compared to previous generations, that trend is changing: Gen Y has increased their total wealth by over 800% in the past decade, now owning 5.6% of global wealth, compared to less than 1% in 2012.

If this trend continues, ensuring your book of business has a healthy millennial population might just be in your best interest professionally.

Advising Gen Y FAQ

What are millennials looking for in a financial advisor?

The most desired service Gen Y seeks in financial advisors is financial planning services. They are also interested in being educated on financial matters, as well as investing strategies. Beyond these distinctions, they're seeking advisors they can trust, who listen to them and will provide them short and long-term value.

Are millennials open to taking financial advice?

Definitely. Unfortunately (according to Forbes), nearly 80% of millennials get their financial advice from social media. So, while they're open to receiving advice in the realm of finance, many are not going to the right place to get it.

What percent of millennials use a financial advisor?

75% of millennials surveyed indicated that they have a relationship with a professional financial advisor. How many of those were referring to some financial influencer ("finfluencer") on TikTok, however, is unclear.

How do I connect with millennials who want financial advice?

If you’re looking for some prospecting help, Planswell has you covered. We connect financial advisors with households at the moment they express an interest in learning when they might be able to retire. If you haven’t already, you should consider giving Planswell a shot.

Deciphering the Generation Y financial mindset

From rapidly evolving technological capabilities, to a decades-long war, to the financial crisis of 2008, to the COVID pandemic, millennials have experienced quite a lot for such a young generation.

The result, of course, is that they have a rather different mindset when it comes to financial planning and money in general than their predecessors.

General pessimism

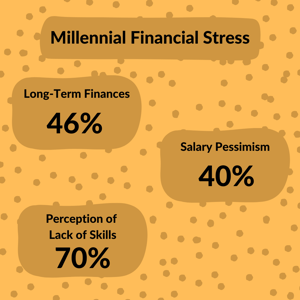

A Deloitte survey of millennial and Gen Z respondents showed a rather bleak outlook, financially speaking. 46% of millennials surveyed indicated they were regularly stressed about their long-term financial future. They were similarly concerned about their career prospects and day-to-day finances as well. 40% of respondents flagged "having a high salary" as an unreasonable goal, and 70% thought they didn't have the skills necessary to compete in the job market.

These concerns about being able to manufacture financial freedom existed before the pandemic, but it certainly did not make things better. Because of the often-crippling student debt and rising housing costs in city centers, few millennials' have the opportunity to practice sound money management, like developing investment portfolios, contributing to retirement accounts, or engaging in financial planning beyond "how do I make this paycheck last until the next one?"

Experiential spending

Millennials spend a considerable amount of money on ephemeral "experiences," as opposed to concrete goods that they might own. For example, travel alone accounts for over $4,000 per year of millennials' annual spending on average.

The trend continues when it comes to food as well. Gen Y spent more money eating out than any other generation. 47% of millennials' food expenditures came from eating out, which is 2% more than Gen X, who came in second place.

A desire to be financial planners

Despite their comparatively high spending on what baby boomers might call wasteful nonsense (e.g. avocado toast brunches), the fact that millennials invest so much of their time worrying about how to meet long term financial goals indicates that they have an inherent interest in getting their own personal finances in order, achieving financial freedom, and ensuring they can meet retirement income goals to maintain their lifestyles long term.

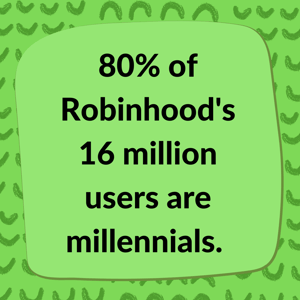

Another stat that gestures at this desire is the fact that investment apps like Robinhood are incredibly popular with millennials. In fact, the average Robinhood user is 31 years old, 80% of their users are under the age of 35, and more than half of them are first-time investors.

How can financial advisors best serve millennials?

Given the veritable fecal storm that has been millennials' lived experience up to this point, most of them could use some assistance in getting their personal finances in order. What form that help takes, however, is important to consider.

Here are some of the largest financial pain points many millennials are experiencing in their everyday lives that a financial advisor such as yourself could help alleviate.

Debt management and consolidation

The average millennial has over $27,000 in debt, and that's not counting their mortgages (millennial homeowners have well over $200,000 in debt on average). While the majority of that number comes from student loans for which payments and interest accrual have been paused, that relief is likely to end in August of 2023.

Once that happens, millennials who were already struggling to make ends meet without having to make monthly student loan payments are going to be in dire straits indeed.

Even those who are lucky enough to have evaded student loans have an average of nearly $5,000 in credit card balances that is likely putting some sort of strain on their monthly finances.

Helping millennials make a plan to streamline their personal financial situation and get to something that resembles financial freedom would be invaluable indeed.

Goal-based savings plans

Just because everyone from their weird uncle to John Oliver keeps telling them they'll never be able to afford a house, doesn't mean millennials don't want to be able to meet their long-term savings goals.

Despite the fact that millennials actually are slightly ahead of Gen X when it comes to amount of education and earnings at their age, they lag behind on saving for retirement, establishing emergency funds, and affording larger purchases like homes and cars.

That means they would benefit immensely as a group from expert advice in the realm of personal finance, which means speaking with an advisor.

Budgeting and day-to-day personal finance

Personal finance is not always offered as a course in high school, and when it is, it tends to be a low-rigor alternative for students who don't want to challenge themselves with honors or AP classes. So, oftentimes, the most educationally successful millennials have the least knowledge when it comes to simple financial topics, like budgeting, investing, and saving for retirement.

Strategies to attract millennials as financial advising clients

If you want to earn the business of young professionals of the millennial generation, you'll have to market to them in ways that will attract their attention. Here are a few ideas that would be work implementing:

- Advertise on social media: Like we mentioned before, millennials spend a lot of time on social media. If you have an advertising budget, it would be best spent on sites like Instagram, Facebook, or TikTok.

- Utilize influencer marketing: even better than advertising on social media platforms, would be to hire an influencer to create advertising content for you.

- Hold events at micro breweries: If there's one thing millennials love more than avocado toast, it's craft-brewed beer. Holding financial literacy or planning workshops at hip venues like this will increase the millennial attendance significantly.

- Use web– or app–based planning software: Millennials do everything on apps these days, from networking to banking to shopping to ordering food. They yearn for apps, and understand them intuitively. If you can provide a financial advising experience that is app-based, you'll be much more likely to attract and hold millennial clients.

- Highlight your commitment to socially responsible business practices: Compared to other generations, millennials tend to be much more socially and environmentally conscious. They'll pay waaaaay more money for basically anything if it's hand stitched by well paid workers or has net-zero carbon impact.

- Use a subscription pricing model for your services: Gen Y is used to having a subscription for basically everything, from their entertainment platforms to their clothing suppliers to the filters they put in their refrigerator's water dispenser. If you can offer a subscription-based pricing model for your financial advice, it will be more familiar to these young people, and they'll be more likely to engage with you.

Just who are these millennials anyway?

Millennials differ significantly from previous generations in more ways than their apparent lack of financial planning knowledge. Here are a few key factors that play a role in determining how Gen Y sets financial goals for themselves and hopes to one day achieve financial independence:

Age

While there is some variation in how various entities designate generational labels, for the most part Gen Y includes people who were born from around 1980 to the mid-1990s or so. With that in mind, your oldest millennials are going to be in their 50s, while the youngest in the group could still be in their late 20s.

Shifting technologies

Older members of the millennial generation were born in a time when a "personal computer" had less processing power than a modern-day calculator; before reaching adulthood they acclimated to both dial-up and high-speed internet, the advent of smartphone technologies, and the viral proliferation of social media.

So, Gen Y tends to be rather adaptable to new technologies and ideas, and feels generally comfortable figuring such things out on their own.

Diversity

According to a study by the PEW Research Center, Gen Y is significantly more ethnically and racially diverse than older generations, and that trend is only increasing over time.

Education & student debt

Millennials are on track to be the most educated generation of them all. PEW Research data collected in 2008 indicates that nearly 40% of 18 to 24 year olds were enrolled in higher education.

As you might expect, this trend ties directly into another: millennials hold a whopping 30.4% of the $1.63 trillion in student debt currently at large in the United States. This averages out to around $33,000 in debt per millennial.

Social media addicts

Social media has a greater influence on Generation Y's day-to-day than perhaps any other generation (although Gen Z will probably usurp that crown one day). Here are just a few statistics surrounding millennial social media usage that help to illustrate this point, courtesy of our friends over at Gitnux.

- 92% use social media on a daily basis, and 71% check their social media accounts multiple times per day.

- 75% consider social media to be an essential part of their daily life.

- 34% spend more time on social media than they do watching TV (2 hours and 38 minutes per day, on average).

Delayed milestones

While the pandemic hit most Americans rather hard, causing them to delay major financial goals like buying a home or a car, members of Generation Y were nearly twice as likely to have done so than members of older generations.

.png)